Swiggy and Zomato are sitting on a goldmine

How can the grocery business become profitable?

Hello

Is it just me or do you feel happy too when Indian startups show signs of profitability? For years people have been saying that there is no money to be made in the country where the bottom 50 per cent earned just Rs 50k per year.

That just makes Zomato’s achievement even more incredible.

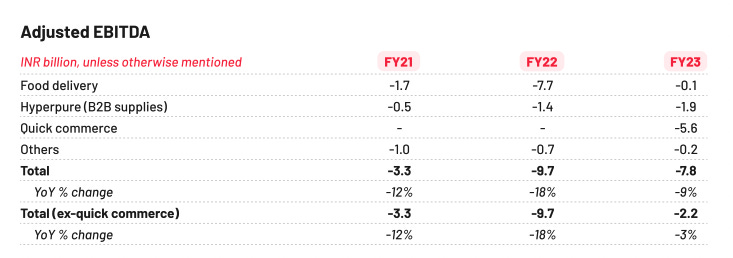

Now that I (pretend to) understand EBITDA and PAT, I went through Zomato’s annual report and understand where the profitability is coming from, and which vertical is bleeding the most amount of money.

As you can guess, the grocery vertical bleeds the most amount of money.

It is incredibly hard to build a quick commerce business in India.

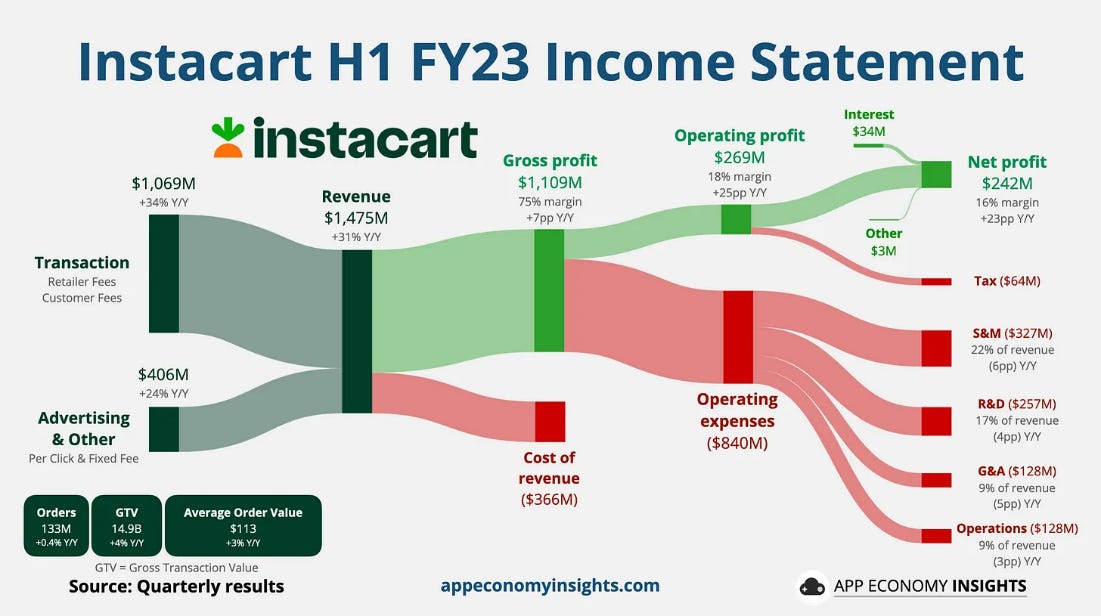

But there is one company that is making money in the grocery business. They recently went public too. Behold Instacart. Instacart is an American delivery company that operates a grocery delivery and pick-up service in the United States and Canada. Customers use their app to select groceries from retailers (like Walmart, Target etc.). Instacart then assigns a “shopper” who picks the groceries up and delivers them to the customer.

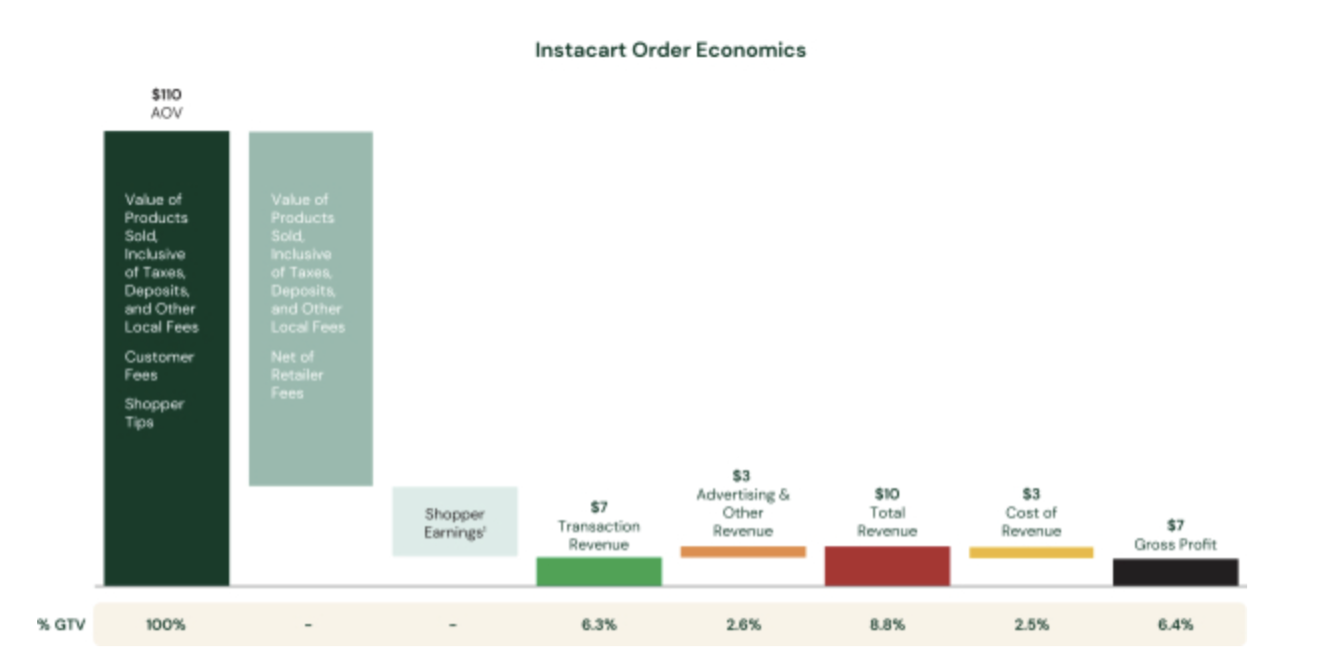

Though this model is quite different from Instamart/Blinkit which use a dark store and promise faster deliveries, there is one thing that Instacart does which might change the game for Swiggy/Zomato. Let’s see if you can figure out from the picture.

Notice anything? Apart from the average order value which is very high (110$ compared to Blinkit’s 540 Rs.) there is a small orange colored bar in the picture titled “Advertising and other revenue” which makes up for 30% of their per order revenue.

Why does a grocery app have advertisement? Also, why would anyone want to advertise on Instacart?

That is the topic of today’s edition.

I think Instacart is not just a “grocery delivery business”. It is also an advertising and subscription business. Instacart+ Subscription is exactly like Swiggy One or Zomato Gold where subscribers get perks like free delivery, discounts etc.

Subscribers to Instacart+ shop with greater frequency and with higher average order value than non-members, and Instacart+ generated 57% of the company’s GTV in the first six months of 2023.

There are two reasons why brands want to advertise on Instacart. One is Apple’s app tracking transparency (ATT) rule. I mentioned this in the newsletter titled “Apple is killing free internet”. Basically, Apple does not allow apps (like Decathlon and NDTV) to send user data to 3rd party companies like Facebook, Instagram or Google. This reduces Facebook’s ability to target users properly which in turn reduces a brand’s Return on Ad Spend (ROAS). This makes brands switch to other prospects – one of them is Instacart which has a lot of user data and does not need to send or receive data from Facebook.

The second reason is that they have built a brilliant ad product. That’s not surprising given that they hired Fidji Simo as CEO who is primarily credited with having built Facebook’s mobile advertising platform. Let’s see how this looks in the app.

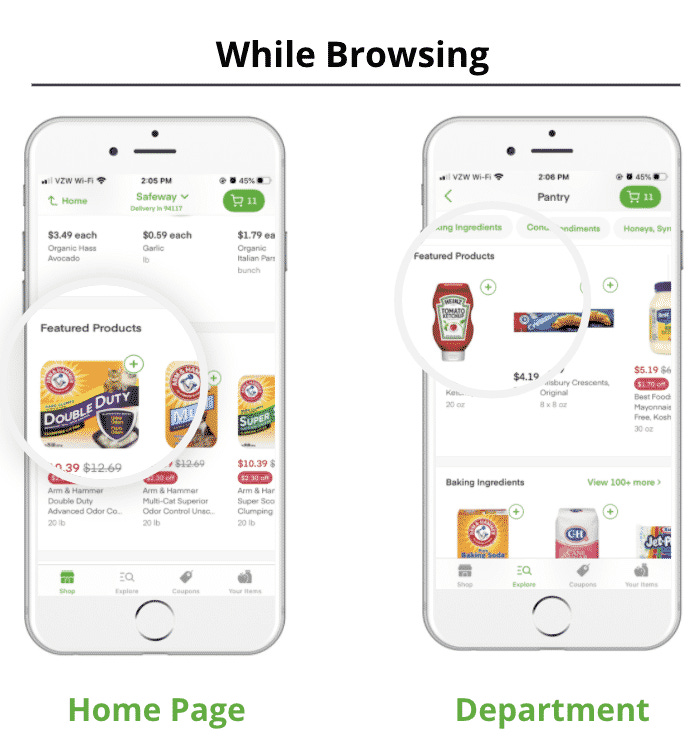

Instacart allows users to purchase groceries and other packaged goods from nearby stores via Instacart’s mobile app and from its website. Instacart’s ad product allows brands to display their products prominently in various placements (search results, category discovery, post-checkout suggestions, hero banner) based on relevance. Notably, this “Featured Products” ad product is designed for brands to drive sales of their products.

It is a completely self-served ad platform. Brands can choose what their objective is – Drive Sales, Engage Consumers or Expand Reach.

To give you an example from an Indian context – Pepsi can run a search ad on Instacart such that whenever someone searched for “Coke” they will see a sponsored result selling Pepsi.

Ads seem to be working too. 40% of Instacart’s H1 FY23 revenue came from ads.

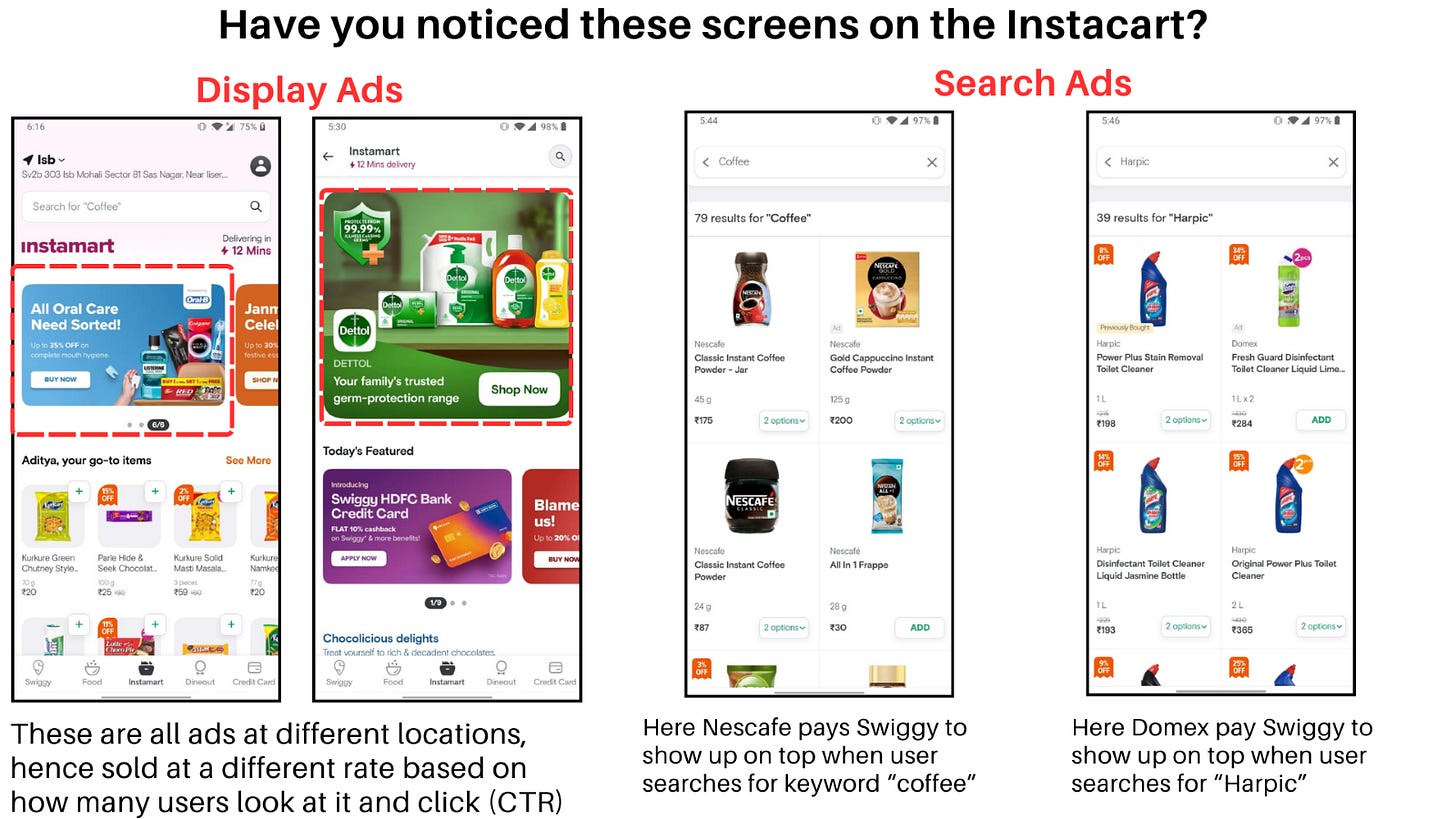

That’s the goldmine Swiggy/Zomato are sitting on, and they have already started to dig into it. Have you noticed these screens on the app?

These are all ads, and they will continue to get better with time. I have no doubts about Zomato/Swiggy’s ability to build an ad platform and I’m quite sure that we are going to see short reel-length ads on these apps very soon.

But there are a lot of problems that they will have to figure out like – How many ads can you show a user before they churn out? How much are the brands in India willing to pay? Will they pay for search ads or display ads? Will the ad platform have enough return on investment?

One last thing. Apple’s App Tracking Transparency is a very important part of the puzzle here. Meta (Instagram/Facebook) is one the largest ad platforms in the world and companies spend a large share of their budget on Insta ads but (as I mentioned in one of the previous newsletters) this new rule has hit Meta very hard. Due to this new rule companies are looking for other platforms to advertise on.

My guess is that a lot of new platforms are going to start serving ads and existing platforms will make a lot of money through ads. We can already see that happening with Hotstar, Uber, Netflix, Shpoify and Indian startups won't be far off too.

Thanks

Aditya